A Call To Action For Canadian Banks To Institute Economic Abuse Prevention Policies

While the Canadian Bankers Association (“CBA”) has gone the extra mile to educate not only banks but the public, generally, about the issue of economic abuse; there is still an enormous amount of work to be done in this area. The CBA addresses the issue, broadly and also provides insights on how to go about obtaining assistance if, indeed, you are being financially abused. The Financial Consumer Agency of Canada (“FCAC”), is the governing authority “responsible for protecting the rights and interests of consumers of financial products and services. It supervises federally regulated financial entities, such as banks, and strengthens the financial literacy of Canadians.”

The FCAC assures us “We are a federal agency that works to keep Canada’s financial system safe and strong.”

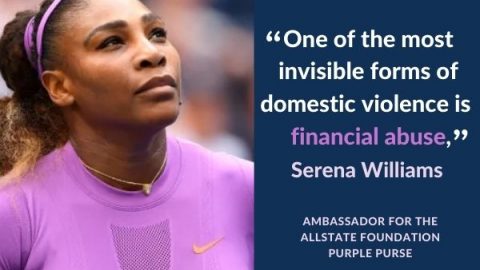

Economic abuse has become such an issue in Canada, however, even Parliament has come to realize there needs to be a more comprehensive strategy “to address financial and economic abuse as a way to prevent intimate partner violence.”

Economic abuse has become such an issue in Canada, however, even Parliament has come to realize there needs to be a more comprehensive strategy “to address financial and economic abuse as a way to prevent intimate partner violence.” It comes as no surprise, I am certain, COVID had a significant impact on the number of victims that experienced economic abuse given the individual isolation attendant to COVID:

“Eighty percent of abuse survivors surveyed in the National Capital Region said that during the COVID-19 pandemic, their current or ex-partner displayed more controlling and coercive behaviours related to their finances and economic stability, said a 2021 report from the centre.” (Citing https://globalnews.ca).

Post-deliberation what has Parliament suggested as a remedy to this epidemic?

“The parliamentary report’s recommendations to the government include reviewing current legislation and policies so they better recognize economic abuse as a form of family violence, including under the federal Divorce Act, the Civil Marriage Act and the Criminal Code.”

It goes without saying then, economic abuse is definitely an issue on the rise and one that seriously requires a greater address.

Currently, Scotiabank does have a Commitment to Respecting and Protecting its’ banking customers with a Human Rights Policy.

Likewise, HSBC has taken steps to adhere to a Code of Ethics that focuses on a pledge to protect its’ customers as evidenced in its’ Statement of Business Principles:

Scotiabank and HSBC have committed to addressing the issue of economic abuse based upon Human Rights yet the majority of Canadian banks still need to set firm Guidelines, Policies and Procedures and provide additional employee training regarding how to protect banking customers and aid in preventing them becoming victims of economic abuse.

While most of us are familiar with the names of the larger banks in Canada it may surprise you just how many banks there are in Canada albeit not all of them provide strictly banking services. Rather, many also offer other types of a la carte financial services, as well.

What does Canada’s banking realm encompass?

“Canada’s banking system includes Schedule I banks (domestic banks), Schedule II banks (foreign bank subsidiaries) and Schedule III banks (branches of foreign banks). With over 280,000 employees, Canadian banks operate through a network of more than 6,300 branches and about 19,000 ATMs across the country. . . .”

Canada’s Vast Extent of Banking Institutions

So one might have a better understanding of the magnitude of Canada’s banking collective a list setting out the number of Canadian banks has been attached for your reference: https://www.relbanks.com/canada. Again, while not all these institutions strictly deal with customer banking the “intel” is definitely eye opening regarding the vastness of Canada’s banking institutions. There are approximately 40 different banks nationwide in Canada managing some form of customer-service banking and/or asset-related transactions and investments.

The Canadian Centre for Women’s Empowerment (“CCFWE”) is an agency steadfast and focused on moving Canada forward to finding solutions to standardize Economic Abuse Guidelines and standardized Policies and Procedures amongst Canadian banks nationwide. Annually the CCFWE promotes a nationwide campaign honouring a pledge to Fight Economic Abuse in their Help Us Rise Campaign. This is not a monetary pursuit, but rather, an organized good faith campaign to attain signatures of Canadians interested in seeking resolution to this epidemic issue. Come join the CCFWE and unite with the organization to propel legislative bodies and banking institutions forward into a financial world where all customers are safe to do their banking including those that have or are being victimized by economic abuse by signing and submitting the attached pledge to the CCFWE: https://ccfwe.org/the-pledge/. Economic abuse is not strictly a gender-related issue! It is, rather, a human rights issue and one which apparently even Parliament has come to acknowledge and recognize.

“To deny people their human rights is to challenge their very humanity” – Nelson Mandela.

Corinne Isaacs – Social Justice Writer

The Canadian Centre for Women’s Empowerment

CORINNE ISAACS-FRONTIERO – Corinne Isaacs-Frontiero (weebly.com)