CANADIAN CENTER FOR WOMEN’S EMPOWERMENT (CCFWE)

CCFWE Financial Futures Summit:

Best Practices In Banking to Support Survivors of Economic Abuse

November 16th, 2023 | 10 AM – 1:30 PM EST

- Financial Futures Summit Press Release

- Catch up with all conversations and discussions during the Financial Futures Summit. Watch the Summit’s full Video recording

The recently concluded virtual Financial Futures Summit brought together representatives from financial institutions, credit unions, policymakers, frontline staff and advocacy organizations from the UK, Australia and Canada to foster knowledge-sharing and international collaboration.

More than 80 participants from across Canada and around the world joined CCFWE in this groundbreaking event on best practices for a more inclusive financial sector. CCFWE wants to thank its funder, the Federal Department of Women and Gender Equality, Canada for making this summit possible.

The event provided insights into designing equitable financial services and proactive preventative intervention, and participants explored best practices in addressing the banking and financial inclusion needs of survivors of Domestic Financial and Economic Abuse.

Through panel discussions, breakout sessions, and networking opportunities, attendees gained a deeper understanding of how institutions are navigating complexities in supporting survivors.

The event also encouraged collaboration for collective advocacy efforts, contributing to a stronger, more supportive banking ecosystem for Economic Abuse survivors.

In-Conversation: Understanding Economic Abuse in Canada, the UK and Australia

The conversation started the summit by providing context on the advocacy work of three organizations working on Economic Abuse, Surviving Economic Abuse (SEA – UK), Centre for Women’s Economic Safety Ltd (CWES – AUS) and the Canadian Center for Women’s Empowerment (CCFWE). The speakers shared their approaches to removing structural barriers within the financial sector and making financial services more equitable and inclusive.

Speakers:

- Dr. Nicola Sharp-Jeffs, Founder & CEO, Surviving Economic Abuse (SEA) (UK)

- Rebecca Glenn, Founder and CEO, Centre for Women’s Economic Safety Ltd (CWES) (AUS)

- Meseret Haileyesus, Founder & Executive Director, CCFWE (CAN)

[graphic recording by Laura Hanek]

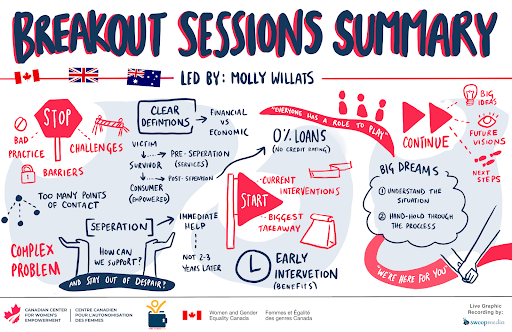

Breakout Room Sessions

During the breakout sessions, participants took a deep dive into some of the strategies and programs that advocacy organizations and financial institutions developed to provide more equitable financial services to survivors and learnt about their success and lessons learnt.

Breakout Session 1:

Fireside chat: How financial services are supporting survivors within the UK

Lauren Garret, Financial Services Manager with the UK-based organization Surviving Economic Abuse (SEA) alongside Jane Roderick, Head of Strategy & Engagement, Customer Inclusion for Lloyds Banking Group, Charity Wood, Head of Customer experience at Starling Bank, and Kate Osiadacz, Head of Responsible Business at TSB, demonstrated how financial services firms are supporting survivors in the UK. SEA first set the backdrop and gave an overview of the regulatory landscape and vulnerability agenda. Starling Bank, TSB and Lloyds Banking Group then shared best practice responses they have implemented to support survivorsrebuilding their lives.

Breakout Session 2:

Economic Abuse: A coordinated community response within the UK

UK’s Surviving Economic Abuse (SEA) Women’s Sector Manager, Naomi Hawthorne, gave participants an insight into SEA’s Compass project aimed to generate practice responses to Economic Abuse in local community settings. It co-develops a model of economic advocacy that ensures survivors’ economic needs and safety are addressed and works to increase long-term safety.

Breakout Session 3:

Designed to Disrupt: Reimagining banking products in Australia

Australian-based Catherine Fitzpatrick, Flequity Ventures together with the organization Centre for Women’s Economic Safety Ltd gave an overview of the Designed to Disrupt paper and shared in an interactive case study of potential design changes to two products to prevent Economic Abuse. Participants gained knowledge on examples of how banking products may be weaponized as tactics of Financial Abuse, steps to financial safety, and potential changes to banking product designs to disrupt Economic Abuse.

After the breakout sessions, all participants reconnected for a group reflection on current challenges that financial institutions, regulators and fintech space are facing to support survivors and current interventions and strategies that are currently happening and proved successful in making financial services more inclusive. Attendees finally also shared their main takeaways from the breakout sessions and a potential outlook in the future of banking.

[graphic recording by Laura Hanek]

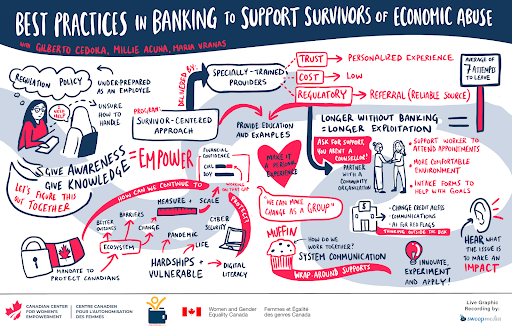

Panel: Canada’s Progress on Banking for Survivors

The panel finished off the summit and solidified key learnings, highlighting the macro- and systems-level trends in Canada. The speakers offered participants a view of where the avenues for change exist in Canada from a banking, policy and frontline perspective and provided inspiration on concrete next steps.

Speakers:

- Gilberto Cedolia – Director AML, Compliance and Financial Access Program, Scotiabank

- Millie Acuna – Manager, Asset Building Programs at SEED Winnipeg

- Maria Vranas, Manager Partnership and Stakeholder Engagement, Financial Consumer Agency of Canada

[graphic recording by Laura Hanek]

Moderators and main organizers:

Molly Willats, Finance Task Force Coordinator, CCFWE, molly.willats@ccfwe.org

Michaela Mayer, Director of Policy, CCFWE, michaela.mayer@ccfwe.org

The video recording of the whole Financial Futures Summit can be viewed here:

Acknowledgments

We also acknowledge support agencies working with victims/survivors on their journey to safety, recovery, and prevention.

We would like to acknowledge the many women who have survived intimate partner violence and recognize their courage, strength, and acts of resistance and resilience.

We thank the Minister for Women and Gender Equality of Canada for making the funding available for this vital work.

Funded by the Government of Canada and Women and Gender Equality Canada.

Panelists’ Profiles

Rebecca Glenn

Founder and CEO, Centre for Women’s Economic Safety Ltd

Rebecca founded the Centre for Women’s Economic Safety (CWES) to raise awareness of economic abuse as a form of domestic and family violence and advocate for structural and systems change to support women’s economic safety. From 2018 to 2021 she worked at Insight Exchange; a domestic violence initiative with a focus on resistance and responses to violence and abuse.

Before Insight Exchange and CWES, she worked for Australia’s largest bank developing its employee financial wellbeing program. As a member of the Commonwealth Bank’s Domestic and Family Violence Working Group, Rebecca worked with a range of experts to develop the Women’s Financial Wellbeing Guide and partnered with Domestic Violence New South Wales to produce the Addressing Financial Abuse Guide. She also led development of the bank’s first Financial Inclusion Action Plan.

Rebecca previously led the Communications and Marketing function at Australia’s peak body for superannuation, ASFA, and was the Campaign Director for MoneySmart Week before being appointed founding CEO of not-for-profit organisation, Financial Literacy Australia in 2013.

In 2019, she was awarded a Churchill Fellowship to investigate service responses to women experiencing or escaping domestic economic abuse in the UK, USA and Canada.

Catherine Fitzpatrick

Catherine is Founder & Director of independent consultancy Flequity Ventures.

A former bank executive, she works with businesses to reimagine and redesign products and services to

be more flexible, safe and equitable for their customers experiencing vulnerability.

Her aim is to inspire innovation to disrupt financial abuse and address gender bias in financial products

– helping to close the economic gap for women.

Catherine was recognised nationally in 2018 as an AFR|Qantas 100 Women of Influence for her work as the architect of Commonwealth Bank’s domestic and family violence strategy.

She holds a number of advisory positions, including as the only business representative appointed to the Australian Government’s advisory group on the National Plan to End Violence Against Women and Children 2022-2032.

She is Chair of the Australian National University’s Student Safety and Wellbeing Committee, Adjunct Associate Professor at the University of New South Wales School of Social Sciences and a member of the Monash Safe and Equal @ Work Advisory Board.

Catherine is the author of Designed to Disrupt: Reimagining banking products to improve financial safety – the first of a series of discussion papers for the Centre for Women’s Economic Safety.

Gilberto Cedolia

Director AML, Compliance and Financial Access Program, Scotiabank

Gilberto L. Cedolia is a banking professional, with a background in corporate finance, financial risk management and social sustainability practices. In his current role, Gilberto is a Director on Scotiabank’s AML Risk Advisory team. Since 2019, Gilberto has been leading the Bank’s Financial Access Program: a financial inclusion initiative that supports survivors of human trafficking and domestic abuse to gain access to banking services in Canada. In addition, he is a member of CCFWE’s Financial Taskforce, sits on the board of directors of VoiceFound, a front-line, human trafficking support organization, and is also a member of CivicAction’s DiverseCity Fellows leadership program for 2023/24. Gilberto holds a Master of Business Administration from the DeGroote School of Business, McMaster University.

Lauren Garrett

Financial Services Manager, Surviving Economic Abuse

Lauren is the Financial Services Manager at SEA. Lauren has 10+ years of experience working in the financial services sector, specifically in complaint resolution, vulnerability and accessibility. Lauren leads on SEA’s work with financial services seeking to transform industry responses to economic abuse. Lauren’s team delivers training and consultation across the sector to raise awareness of what economic abuse is and amplify the voices of victim-survivors to ensure they receive fair outcomes.

Millie Acuna

Manager, Asset Building Programs at SEED Winnipeg Inc

Millie comes from a unique blend of industry and non-profit experience in providing financial access to low-income Canadians through 15 years of employment with a local credit union and in the current role as Manager of Asset Building Programs at SEED Winnipeg.

As part of the credit union system, Millie worked in various management roles for seven retail branches, process improvement, community financial access programs, and supported the credit union through audit and risk procedures, a four-way credit union merge, banking system conversion and established a student-run credit union for a Winnipeg inner-city high school.

At present, Millie coordinates the delivery of financial empowerment programs through over 100 community agencies by providing on-site services, service provider training, and mentorship. Program interventions include financial literacy and access to banking.

Millie is passionate about serving unbanked/underbanked individuals, strengthening relationships within the community, and supporting financial empowerment for all to build a sustainable future.

Maria Vranas (FCAC/ACFC)

Acting Director of Behavioural Finance Lab, FCAC

Maria is the Acting Director of the Behavioural Finance Lab at the Financial Consumer Agency of Canada (FCAC). The FCAC’s mandate is to supervise financial institutions’ compliance with consumer protection legislation and to strengthen the financial literacy of Canadians.

Maria leads an interdisciplinary division of researchers and designers in analyzing emerging issues in the consumer protection field, and designing digital tools and behavioural interventions to strengthen the financial resilience and wellbeing of Canadians.

Maria has been with FCAC since 2010 holding leadership roles in Financial Literacy, Consumer Education and Stakeholder Engagement. Prior to joining the FCAC, Maria worked in Ottawa’s high-tech industry. Maria holds a Bachelor of Commerce (Honours) from the University of Ottawa.

Dr. Nicola Sharp-Jeffs

Founder and CEO, Surviving Economic Abuse

The charity is led by our founder and CEO, Dr Nicola Sharp-Jeffs OBE, who is supported by a growing team and Board of Trustees. Nicola is an expert in economic abuse as it occurs within the context of coercive control. She has worked in the violence against women and girls (VAWG) sector since 2006 in both policy-influencing and research roles.

In 2016, Nicola was made a Winston Churchill Fellow and travelled to the United States and Australia to explore innovative responses to economic abuse. It was her determination to ensure that women in the UK have access to the same responses that led her to establish SEA. Read more about her work as part of the Winston Churchill Fellowship (under ‘Economic abuse and policy’).

Nicola is also an Emeritus Research Fellow in the Child and Woman Abuse Studies Unit (CWASU), London Metropolitan University.

In 2020, Nicola was awarded an OBE in the Queen’s Birthday Honours for services to victims of domestic and economic abuse in recognition of her work. She was the 2020 winner of the Third Sector Award for Rising Chief Executive and also named ‘Rising Leader of the Year‘ in 2021 by the Charity Times Awards.

Naomi Hawthorne

Naomi has committed her career, spanning over 10 years, to the UK Violence Against Women and Girls (VAWG) sector in various frontline, training, consultancy and management roles. Naomi brings her passion and dedication to her current role as Women’s Sector Manager at Surviving Economic Abuse (SEA) – the only UK based charity dedicated to raising awareness of economic abuse and transforming responses to it. Naomi is responsible for the development and implementation of SEA’s strategy for influencing positive and lasting changes to professional response and systems change in the women’s sector, and also is leading on SEA’s survivor engagement strategy.

Meseret Haileyesus

Meseret Haileyesus is a multi-award-winning thought leader and change-maker with a distinguished record in championing economic justice and health equity. For the past 22 years, she has dedicated her life to advancing progressive policies on access to reproductive health, women’s and children’s health, global health research, financial empowerment, racial justice, and women’s economic rights. As the visionary founder of the Canadian Centre for Women’s Empowerment (CCFWE), she has been unflagging in her efforts to address economic disparities and dismantle systemic barriers that hinder women’s economic advancement. Through pioneering policy advocacy, groundbreaking research, educational initiatives, and programs preventing Economic abuse, Meseret is at the forefront of this critical work.

Her primary mission is to shape public policy and legislative decisions that empower victims of Economic Abuse to achieve economic independence in Canada. Meseret is dedicated to bridging gaps in existing approaches to combat economic abuse. Her commitment to societal improvement extends beyond CCFWE. Meseret is also the Founder of Maternity Today, an organization dedicated to sharing evidence, resources, and advocay tools with healthcare workers. Meseret serves on the Board of Directors at Centertown Community Health Centre and the End FGM Canada Network. She is actively engaging as a subject matter expert with various World Health Organization taskforces, Service as a Policy Advisor of the Network for the Advancement of Black Communities and the Governance Committee for the City of Ottawa’s Community Safety Wellbeing Plan, aimed at addressing poverty, systemic racism, gender-based violence, and mental health challenges youth and their women face in Canada.

Financial Futures Summit Press Release

Best Practices In Banking to Support Survivors of Economic Abuse: Read the Financial Futures Summit Report

Catch up with all conversations and discussions during the Financial Futures Summit. Watch the Summit’s full Video recording.