WHAT IS ECONOMIC ABUSE?

CANADIAN CENTER FOR WOMEN'S EMPOWERMENT

WHAT IS ECONOMIC ABUSE?

“Women in intimate partner relationships may experience Economic Abuse in a variety of forms. It may involve being denied access to bank accounts, information and decision-making rights regarding family finances or having severely curtailed choices regarding purchases. It may involve being financially dependent or not having enough money to buy food, nappies, baby formula, and sanitary products or to pay essential bills. Women can be forced to account for every penny with receipts or to pay off debts accrued by their partners. Following relationship breakdowns, Economic Abuse is commonly experienced through the withholding or manipulation of child support entitlements.” [Branigan, Elizabeth. (2007).]

Economic Abuse is a seldom-talked-about yet prevalent issue faced by survivors of domestic violence in Canada. It is experienced by more than 95% of domestic violence victims. Economic Abuse can have a profoundly devastating effect on women: it impacts mental health and impedes a woman’s ability to leave an abuser, subsequently prolonging the amount of time she is vulnerable to harm.

Economic abuse is experienced by women from all backgrounds, regions, and income levels. Women from marginalized groups, including Black, racialized, and Indigenous women (BIPOC), are at a higher risk of Economic Abuse.

ECONOMIC ABUSE VS FINANCIAL ABUSE

People commonly use the terms Economic Abuse and Financial Abuse interchangeably, since they involve similar behaviors. It can be helpful to think of financial abuse as a subcategory of Economic Abuse. (Dr Nicola Sharp-Jeffs SEA resources)

Economic Abuse incorporates a range of behaviors that allow a perpetrator to control someone else’s economic resources or freedoms. Economic Abuse is wider in its definition than ‘Financial Abuse’, a term usually used to describe denying or restricting access to money, or misusing another person’s money. In addition to that, Economic Abuse can also include restricting access to essential resources such as food, clothing or transport, and denying the means to improve a person’s economic status (for example, through employment, education, or training). (Dr Nicola Sharp-Jeffs (2008)

“Financial abuse involves a perpetrator using or misusing money which limits and controls their partner’s current and future actions and their freedom of choice. It can include using credit cards without permission, putting contractual obligations in their partner’s name, and gambling with family assets. It can leave them without access to their own bank accounts, with no access to any independent income, and with debts that have been built up by abusive partners set against their names. Even when a survivor has left the home, financial control can still be exerted by the abuser with regard to child maintenance.” [women’s aid UK]

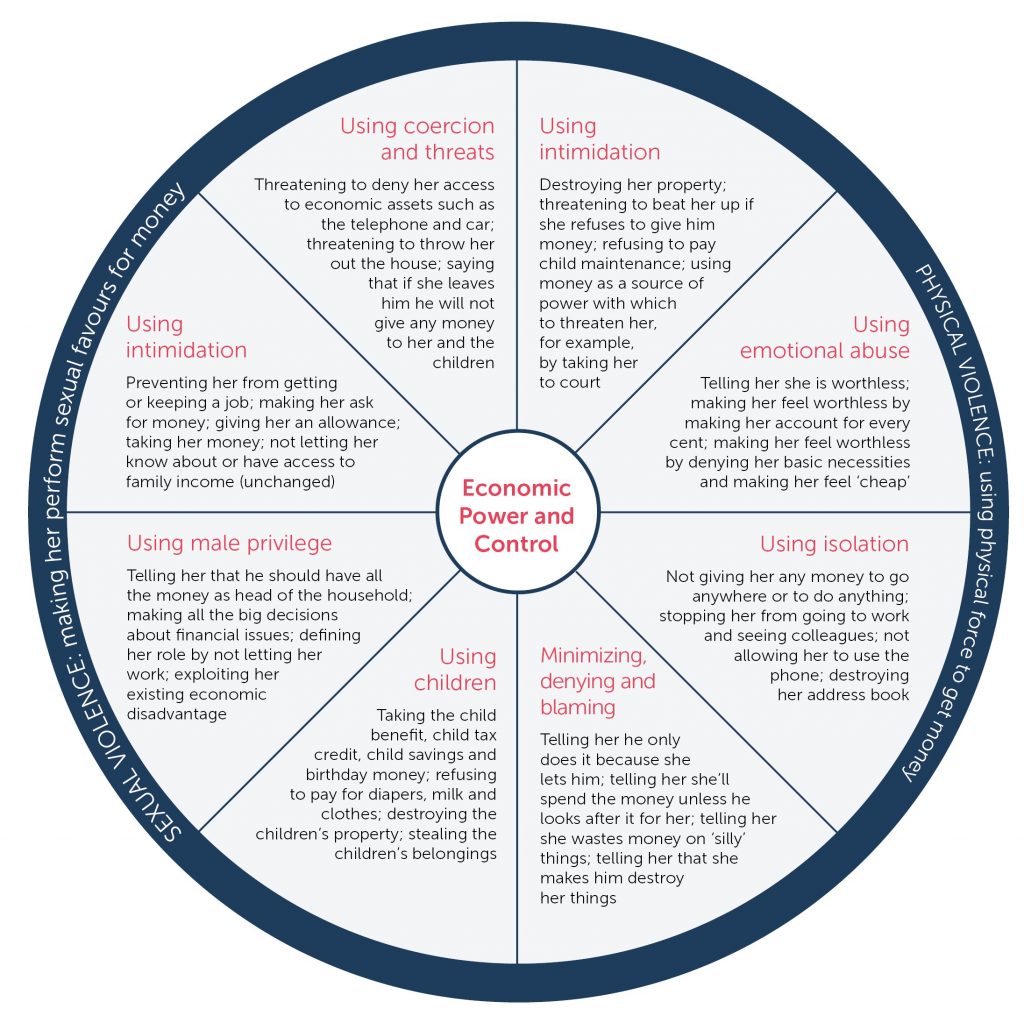

The research suggests that economic abuse is more complex. Dr.Sharp (2008) identifies three different ‘types of Economic Abuse:

- Sabotage how you acquire money and economic resources

- Restrict how you use money and economic resources

- Exploit your ability to maintain economic resources

This is broadly consistent with Postmus et al. (2012) who suggest three forms of Economic Abuse.

Economic Abuse and Tactics

1. Economic abuse (EA) – Behaviors that control a victim’s ability to acquire, use, and maintain resources, thus threatening his or her economic security and potential for self-sufficiency. (Adams et al., 2008 )

Tactics

- Interfering with your efforts to maintain a job by sabotaging childcare, transportation, or other arrangements

- Harassing you at work

- Refusing to work

- Not including you in family financial decisions

- Not allowing you access to the family finances

- Making you ask for money

- Taking your money

- Demanding an account of everything you buy

- Controlling your access to financial information

- Not allowing you to talk to others about money

- Not allowing your name to be on accounts, which would allow you to build credit

- Forcing you to put your name on accounts and then destroying your credit

- Making fun of your financial contribution and saying it is not worth anything

- Expecting you to behave in a certain way because you make less money or are not the “breadwinner”

- Destroying or interfering with homework

- Preventing you from learning English

- Forcing you to work “illegally” when you do not have a work permit

- Threatening to report you to police if you work “under the table”

- Taking the money your family back home was depending on you to send to them

- Forcing you to sign papers in English that you do not understand i.e. court papers, immigration papers

2. Economic Control (EC) – EC occurs when the perpetrator prevents the victim from having access to or knowledge of the finances and from having any financial decision-making power.

Tactics

- Controlling and limiting the victim’s access to financial resources

- Denying the victim access to necessities, such as food, clothing, and/or medications

- Tracking the victim’s use of money

- Withholding or hiding jointly earned money

- Preventing the victim from having access to a bank account

- Lying about shared properties and assets

(Anderson et al., 2003; Brewster, 2003; Postmus, Plummer, et al., 2015; Sanders, 2015; Stylianou et al., 2013; VonDeLinde, 2002; Wettersten et al., 2004)

3. Employment Sabotage (ES)- ES encompasses behaviors that prevent the victim from obtaining or maintaining employment.

Tactics :

- Forbidding, discouraging, or actively interfering with the victim’s employment and/or educational endeavors

- Harassing the victim at his or her place of employment

- Obstructing victim from receiving other forms of income such as child support, public assistance, or disability payments

Alexander, 2011; Anderson et al., 2003; Brewster, 2003; Moe & Bell, 2004; Postmus, Plummer, et al., 2015; Riger, Ahrens, & Blickenstaff, 2000; Sanders, 2015; Stylianou et al., 2013; Swanberg & Logan, 2005; Swanberg & Macke, 2006; Tolman & Raphael, 2000; VonDeLinde, 2002; Wettersten et al., 2004.

4. Economic Exploitation (EE)

EE occurs when the perpetrator intentionally engages in behaviors aimed to destroy the victim’s financial resources or credit.

Tactics :

- Stealing money, checks, or automated teller machine (ATM) cards

- Opening or using a victim’s line of credit without permission

- Refusing to pay bills or running up bills under the name of the victim or his or her children

- Gambling jointly earned money

(Alexander, 2011; Anderson et al., 2003; Brewster, 2003; Moe & Bell, 2004; Postmus, Plummer, et al., 2015; Riger, Ahrens, & Blickenstaff, 2000; Sanders, 2015; Stylianou et al., 2013; Swanberg & Logan, 2005; Swanberg & Macke, 2006; Tolman & Raphael, 2000; VonDeLinde, 2002; Wettersten et al., 2004.)

Adapted with permission from: DOMESTIC ABUSE INTERVENTION PROGRAMS,

202 East Superior Street, Duluth, Minnesota 55802, 218-722-2781 www.theduluthmodel.org

Sharp, N. (2008) ‘What’s yours is mine’ The different forms of economic abuse and its impact on women and children experiencing domestic violence, Refuge

THE IMPACT OF ECONOMIC ABUSE

Women’s experiences of economic abuse and the effects of these experiences on their live are varied and complex.

Physical Impact: health risks from stress and malnutrition.

Emotional Impact: Anxiety, fear, guilt, powerlessness and internalized worthlessness.

Some women adopt survival strategies such as hiding cash and non-perishable food, they develop a constant fear of not having the bare minimum to meet basic needs.Some women develop feelings of guilt for attending to the basic financial and material needs.

Economic Impact: Poverty, homelessness, debt, damaged credit record and bankruptcy.

The impact of economic abuse on a victim’s financial security can be long-lasting. It doesn’t end when the relationship does. It prevents recovery and becoming independent. Interferance with education and employment can make it difficult to find or keep a job. After separation, an abuser may use family law and child support to control and damage a victim’s financial security and independence. Victims may also be left responsible for debts built up by their ex- partner, making it hard to get home, get a loan for a car and meet day-to-day costs.

Economic abuse can contribute to a lifetime of economic struggle for women. Some victims are left homeless, unemployed, and unable to access resources to rebuild their lives. It can leave others staying with an abusive partner longer than they would like and experiencing more harm.

Economic abuse can be devastating and can ruin credit and create legal issues.

If you have experienced economic abuse, you are not alone. There are people and organizations that can help. Check resources that can help