November 16th, 2023 | 10 AM – 1:30 PM EST

The recently concluded virtual Financial Futures Summit brought together representatives from financial institutions, credit unions, policymakers, frontline staff and advocacy organizations from the UK, Australia and Canada to foster knowledge-sharing and international collaboration.

More than 80 participants from across Canada and around the world joined CCFWE in this groundbreaking event on best practices for a more inclusive financial sector. CCFWE wants to thank its funder, the Federal Department of Women and Gender Equality, Canada for making this summit possible.

The event provided insights into designing equitable financial services and proactive preventative intervention, and participants explored best practices in addressing the banking and financial inclusion needs of survivors of Domestic Financial and Economic Abuse.

Through panel discussions, breakout sessions, and networking opportunities, attendees gained a deeper understanding of how institutions are navigating complexities in supporting survivors.

The event also encouraged collaboration for collective advocacy efforts, contributing to a stronger, more supportive banking ecosystem for Economic Abuse survivors.

In-Conversation: Understanding Economic Abuse in Canada, the UK and Australia

The conversation started the summit by providing context on the advocacy work of three organizations working on Economic Abuse, Surviving Economic Abuse (SEA – UK), Centre for Women’s Economic Safety Ltd (CWES – AUS) and the Canadian Center for Women’s Empowerment (CCFWE). The speakers shared their approaches to removing structural barriers within the financial sector and making financial services more equitable and inclusive.

Speakers:

- Dr. Nicola Sharp-Jeffs, Founder & CEO, Surviving Economic Abuse (SEA) (UK)

- Rebecca Glenn, Founder and CEO, Centre for Women’s Economic Safety Ltd (CWES) (AUS)

- Meseret Haileyesus, Founder & Executive Director, CCFWE (CAN)

[graphic recording by Laura Hanek]

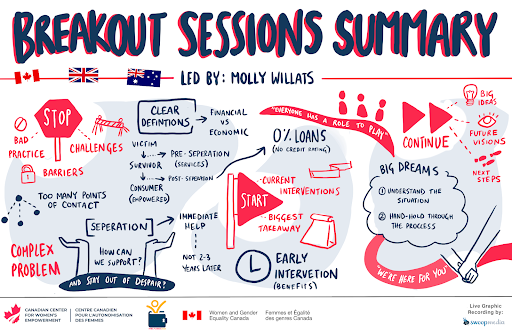

Breakout Room Sessions

During the breakout sessions, participants took a deep dive into some of the strategies and programs that advocacy organizations and financial institutions developed to provide more equitable financial services to survivors and learnt about their success and lessons learnt.

Breakout Session 1:

Fireside chat: How financial services are supporting survivors within the UK

Lauren Garret, Financial Services Manager with the UK-based organization Surviving Economic Abuse (SEA) alongside Jane Roderick, Head of Strategy & Engagement, Customer Inclusion for Lloyds Banking Group, Charity Wood, Head of Customer experience at Starling Bank, and Kate Osiadacz, Head of Responsible Business at TSB, demonstrated how financial services firms are supporting survivors in the UK. SEA first set the backdrop and gave an overview of the regulatory landscape and vulnerability agenda. Starling Bank, TSB and Lloyds Banking Group then shared best practice responses they have implemented to support survivorsrebuilding their lives.

Breakout Session 2:

Economic Abuse: A coordinated community response within the UK

UK’s Surviving Economic Abuse (SEA) Women’s Sector Manager, Naomi Hawthorne, gave participants an insight into SEA’s Compass project aimed to generate practice responses to Economic Abuse in local community settings. It co-develops a model of economic advocacy that ensures survivors’ economic needs and safety are addressed and works to increase long-term safety.

Breakout Session 3:

Designed to Disrupt: Reimagining banking products in Australia

Australian-based Catherine Fitzpatrick, Flequity Ventures together with the organization Centre for Women’s Economic Safety Ltd gave an overview of the Designed to Disrupt paper and shared in an interactive case study of potential design changes to two products to prevent Economic Abuse. Participants gained knowledge on examples of how banking products may be weaponized as tactics of Financial Abuse, steps to financial safety, and potential changes to banking product designs to disrupt Economic Abuse.

After the breakout sessions, all participants reconnected for a group reflection on current challenges that financial institutions, regulators and fintech space are facing to support survivors and current interventions and strategies that are currently happening and proved successful in making financial services more inclusive. Attendees finally also shared their main takeaways from the breakout sessions and a potential outlook in the future of banking.

[graphic recording by Laura Hanek]

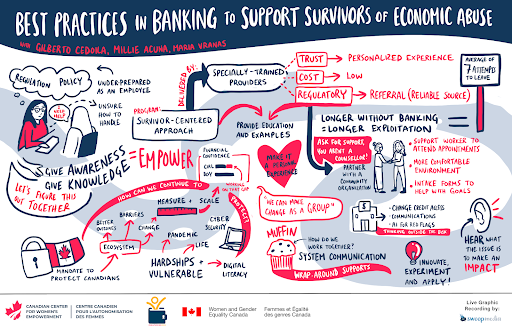

Panel: Canada’s Progress on Banking for Survivors

The panel finished off the summit and solidified key learnings, highlighting the macro- and systems-level trends in Canada. The speakers offered participants a view of where the avenues for change exist in Canada from a banking, policy and frontline perspective and provided inspiration on concrete next steps.

Speakers:

- Gilberto Cedolia – Director AML, Compliance and Financial Access Program, Scotiabank

- Millie Acuna – Manager, Asset Building Programs at SEED Winnipeg

- Maria Vranas, Manager Partnership and Stakeholder Engagement, Financial Consumer Agency of Canada

[graphic recording by Laura Hanek]

Moderators and main organizers:

Molly Willats, Finance Task Force Coordinator, CCFWE, [email protected]

Michaela Mayer, Director of Policy, CCFWE, [email protected]

The video recording of the whole Financial Futures Summit can be viewed here: