Written by Meseret Haileyesus, Founder & Executive Director, Canadian Center for Women’s Empowerment (CCFWE) and Co founder of International Coalition Against Economic Abuse (ICAEA)

For decades, survivors and advocates have called for recognition of economic abuse as a form of gender-based violence. Economic abuse occurs when a person controls, exploits, or sabotages another’s access to money, credit, assets, or employment to limit their independence. It can include coerced debt, stolen income, restricted access to joint accounts, or manipulation of credit and benefits. The consequences are profound survivors are often left with ruined credit, homelessness, and barriers to rebuilding their lives.

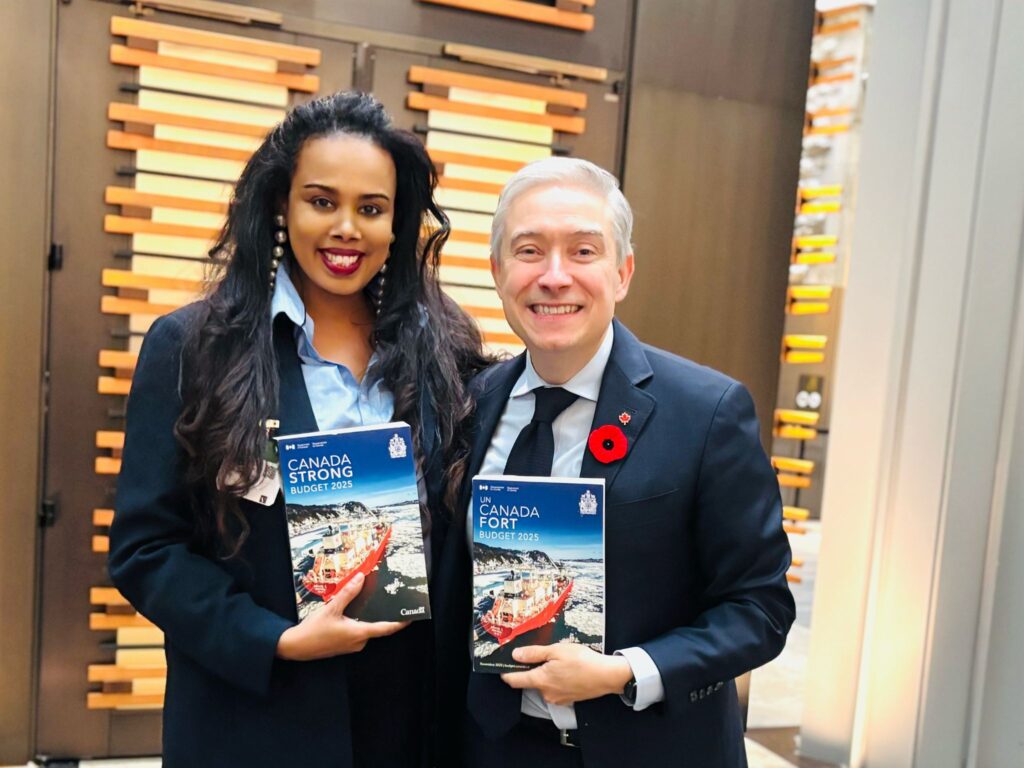

As founder of the Canadian Centre for Women’s Empowerment (CCFWE), I am proud to see that this hidden form of violence is finally being addressed at the policy level. Budget 2025 marks a watershed moment for financial justice, introducing a Code of Conduct for the Prevention of Economic Abuse the first of its kind in Canada’s banking history.

This initiative recognizes what survivors have long known that financial safety is inseparable from personal safety. When women, gender-diverse people, newcomers, and racialized people of Canada face financial control, they face barriers to freedom, dignity, and equality. A fair, transparent financial system must protect its most vulnerable and this budget begins to make that vision real.

Background: Strengthening the Consumer Protection Framework

In June 2022, the Bank Act Consumer Protection Framework came into effect, enhancing Canadians’ rights when dealing with banks. Over the years, additional amendments including the creation of a single external complaints body (2023) and limits on non-sufficient funds (NSF) fees (effective March 2026) have aimed to protect consumers from unfair practices.

Budget 2025 takes the next step forward. It proposes a series of new measures, including legislative amendments, codes of conduct, and policy studies that together signal a new era in consumer protection one that is not only financial but ethical and social.

The government outlines three key priorities

- Improving Canadian’ interactions with banks focusing on affordability and access;

- Increasing competition and innovation and

- Reducing financial fraud and abuse.

At the heart of this framework is a vision of economic abuse: ensuring that Canadians especially women, Indigenous peoples, newcomers, and marginalized groups can engage safely and equitably with financial systems.

1. Tackling Banking Fees and Financial Access

CCFWE has long advocated for fair banking, transparent fees, and open banking, because for many women and gender-diverse people these are not financial issues, they are safety issues.

Affordability remains one of the most urgent challenges for Canadians, especially for survivors navigating the rising cost of living while trying to rebuild their lives. Budget 2025 introduces measures that, while technical on paper, carry deep human impact.

- Eliminating transfer fees on investment and registered accounts will finally stop penalizing people for simply moving their own money, something that often traps survivors in financial dependence.

- Restricting account closure fees during branch closures ensures communities are not cut off from essential financial access.

- Requiring FCAC to review the fairness and transparency of banking fees such as ATM charges, Interac e Transfer costs, and foreign exchange fees brings light to hidden costs that quietly drain low income families.

These reforms move Canada closer to a banking system that is not extractive but protective, one that understands that transparency is not only good policy, it is a lifeline. For survivors of economic abuse, even a single unexplained fee or an inaccessible account can mean choosing between safety and survival.

The budget also reaffirms Canada’s commitment to open banking, giving people more control over their data and financial choices. With oversight shifting from FCAC to the Bank of Canada, consumer driven financial services will have stronger accountability and structure.

At CCFWE we see these changes not as technical adjustments but as part of a larger national shift, where financial systems finally begin to respond to the realities of economic abuse. There is more work ahead, but these steps matter. They bring dignity, autonomy, and hope within reach for millions.

2. Improving Access to Funds

The federal budget takes important steps forward, but it is not enough.

Access to your own money is a basic right. Yet for many people, especially survivors whose accounts are frozen, restricted, or delayed, waiting even a few days can mean crisis. To address this, the government will amend the Bank Act to

- Increase the amount immediately available from deposited cheques from one hundred dollars to one hundred fifty dollars

- Reduce cheque hold periods

- Require banks to resolve misdirected transfers more effectively

These reforms arrive as Canada prepares for the Real Time Rail payment system, which will modernize how money moves and make financial access faster and safer.

For survivors of economic abuse, this is more than a convenience. Faster access to funds can be lifesaving. It can mean escaping violence, paying rent on time, or purchasing food and medication without waiting for clearance. In this way, modernizing payment systems is not only a financial upgrade, it is a step toward protecting human rights.

But we must be honest. These changes, while welcome, are not enough. Survivors need stronger guarantees, faster protection, and systems that recognize the urgency of economic abuse. Canada must continue moving from improvement to full safety and justice.

3. The Code of Conduct for the Prevention of Economic Abuse

This new Code of Conduct represents one of the most transformative measures in Budget 2025. It will set national expectations for how financial institutions must identify, prevent, and respond to economic abuse. The goal is clear: to ensure that victims are no longer punished by systems that overlook financial coercion and harm.

Economic abuse can appear subtle a partner coercing debt in another’s name, restricting account access, or sabotaging credit scores. For too long, banks lacked the tools or frameworks to recognize these red flags. The new Code will bridge this gap by:

- Requiring institutions to implement survivor-centred policies,

- Training staff to recognize and respond to economic abuse,

- Establishing safer banking protocols for victims, and

- Encouraging collaboration between financial institutions, regulators, and gender-based violence organizations.

The government’s guiding principles in the development of the Code of Conduct, including:

- taking an inclusive and victim- and survivor-centered approach

- promoting financial empowerment and independence

- fostering a collaborative approach among stakeholders

- ensuring continuous improvement.

Those principles reflect CCFWE’s recommendations to the federal government in preventing and addressing economic abuse. Victim- must play a leading role from start to finish of this Code to reflect their experiences and needs.

The goal of the proposed Code of Conduct must also ensure the financial empowerment of survivors. This goes beyond ending economic abuse, pushing to promote their economic security and independence, from surviving to thriving.

The Financial Consumer Agency of Canada (FCAC) will oversee compliance, promoting transparency and accountability. Though enforcement remains limited, public reporting and oversight will create pressure for banks to uphold high ethical standards.

At CCFWE, we see this as a monumental shift one that aligns with our national advocacy to embed survivor-informed financial safety frameworks across Canada’s banking and regulatory systems.

4. Fraud Reduction and Financial Crimes

Economic abuse and financial fraud often intersect. Fraudulent loans, identity theft, and coerced credit applications are common tools of abusers. Budget 2025’s introduction of a National Anti-Fraud Strategy and the creation of a Financial Crimes Agency is a welcome step toward addressing these intertwined harms.

The strategy will include new Bank Act requirements that compel banks to:

- Establish comprehensive anti-fraud policies and consumer protections,

- Report data on fraud incidents to the FCAC, and

- Enable customers to disable unnecessary product features that increase risk exposure.

By treating fraud as both a financial and social safety issue, Canada acknowledges that economic harm must be met with coordinated prevention not just punishment after the fact.

What’s Next: From Policy to Practice

Budget 2025 is only the beginning of a larger national transformation. The introduction of the Code of Conduct for the Prevention of Economic Abuse marks a moral and economic milestone but its impact will depend on implementation, accountability, and survivor involvement.

At the Canadian Centre for Women’s Empowerment, we will continue to work with the federal government, financial institutions, and regulators to ensure that the Code moves from policy paper to lived protection.

Our vision is clear:

A Canada where survivors of economic abuse can rebuild safely.

A banking system that values dignity as much as dollars.

A future where financial safety is recognized as a basic human right.

Economic abuse is not just about money it’s about power, autonomy, and justice.

Budget 2025 gives us a foundation. Now, together, we must build the system survivors deserve.